Smiling Through Supply Chain Volatility and Uncertainty

In 1992, Stan Shih, the founder of Acer looked across the personal computer value chain and noticed that the largest share of the real profit was being captured at the upstream and downstream ends of the value chain. Shih noticed: “Acer is doing all the manufacturing grunt work, but we’re not earning nearly as much as the companies who just design or sell the products.” At the time, Acer functioned primarily as an OEM, producing goods for bigger Western brands. In terms of the share of value captured, Acer occupied the “sagging middle”.

Shih introduced his model of value creation, which became known as the Smiling Curve. It is now a classic framework illustrating the asymmetry in value creation distributed across the stages of a supply chain. According to Shih’s curve, the most value resides in the high end of the “smiles”.

Either in upstream activities like: R&D, Product design, Core technology / innovation, Intellectual property

Or in downstream activities like: Branding, Marketing, Sales, Customer service / user experience

The middle of the value stream, comprised of manufacturing, logistics, and core operations captured the least value.

Shih created the smiling curve to explain why companies like Acer needed to move “up” or “down” the value chain stages by investing in their own IP (R&D) or brand (retail and marketing) if they wanted to capture more value, rather than remaining stuck in the low margin middle.

"You don’t win by being stuck in the middle." - Stan Shih.

Shih interpreted the curve as a mandate to outsource or deprioritize midstream activities (manufacturing) and focus on high-value upstream and downstream segments. Over the next 10 years Shih migrated Acer from being an OEM manufacturer and into a global independent brand. By 2000, Acer spun off its contract manufacturing into a separate company called Wistron Corporation and focused on product design and marketing its own branded products. Many industries followed suit. And in some circles today, that slumping middle is regarded as nothing more than a cost center, something commoditized, easily outsourced, and a cost-driven necessity.

Who Were the Winners and Why?

The winners of the traditional Shih Smiling Curve were companies that dominated the high-value ends:

Upstream Leaders: Firms like Apple, Intel, and ARM thrived by investing in R&D and intellectual property. Apple’s design-driven approach and ARM’s licensing of chip architectures captured significant value through innovation.

Downstream Champions: Brands like Nike, Starbucks, and Amazon excelled by prioritizing customer experience, branding, and logistics. Nike’s marketing campaigns and Amazon’s Prime delivery model grew loyalty and high margins.

Why They Won: These companies focused on differentiation through innovation (upstream) and customer proximity (downstream). Manufacturing was outsourced to low-cost partners, allowing these companies to avoid the low-margin middle while leveraging global supply chains.

This strategy worked in a stable, globalizing world, enabling companies to optimize profits by focusing on innovation and customer engagement.

However, it overlooked vulnerabilities like supply chain fragility, which become exposed during disruptions like COVID-19 or geopolitical tensions.

Today’s volatile, uncertain, complex, and ambiguous VUCA World is exposing that the sagging middle of the curve has a weak spot which threatens to derail the value derived at the high ends of the curve. The middle has grown dangerously brittle.

The Brittleness of the Middle

While the high ends of the curve have evolved, with tech and non-tech firms alike scaling brand equity and monetizing customer experience and customization, the middle segment of the chain hasn’t improved at the same rate.

It remains structurally fragile, opaque, and rigid.

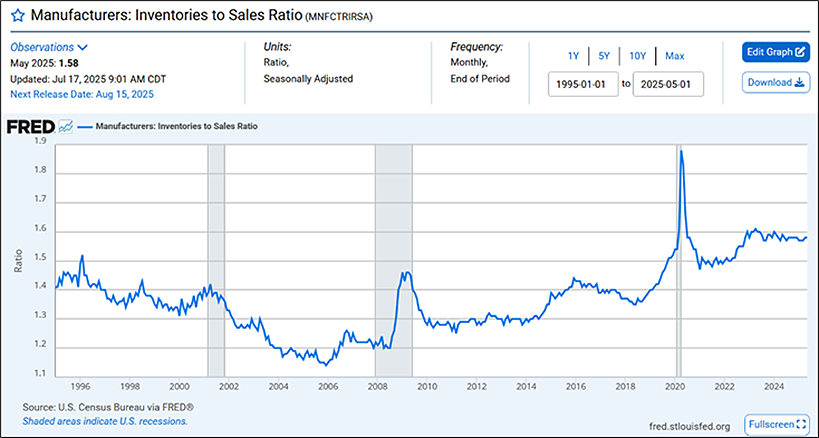

This graph from the St. Louis Federal Reserve shows the Manufacturers' Inventories to Sales Ratio (seasonally adjusted, monthly) from 1995 to May 2025. It tracks how many months’ worth of inventory U.S. manufacturers are holding relative to sales.

1. Long-Term Flatness with Episodic Spikes

From 1995 through 2020, the inventory-to-sales ratio remained relatively flat or declining, hovering mostly between 1.2 and 1.4. This implies that decades of tech investment and supply chain management progress did not fundamentally improve inventory efficiency at the macro level. The system remained vulnerable, achieving "efficiency" without true agility or resilience.

2. COVID Shock in 2020

The massive spike in 2020 (peaking near 1.85) coincides with the pandemic’s supply chain disruptions. Inventories ballooned while sales plummeted due to shutdowns. The supply chain was exposed as brittle under stress. The system couldn’t dynamically adapt to demand shocks.

3. Post-COVID Plateau at a Higher Level

From 2021 onward, the ratio settled into a higher band (~1.55–1.6) than the pre-COVID norm (~1.3) and has flatlined since 2022. This flatline reflects a failure of the resiliency needed to return the system to more closely match pre-pandemic levels.

As of May 2025, it's at 1.58 - still elevated, suggesting persistent imbalances and misalignments. Companies are likely carrying more inventory as a hedge, because they lack the confidence in their system’s upstream reliability and demand-supply synchronization.

Flat Ratio = Flat Progress

Despite major technological advances, the inventory-to-sales ratio hasn’t improved structurally in 30 years. That reveals a hidden truth:

Our supply chains became more optimized, not more intelligent.

We improved cost and speed, but not resilience, real-time responsiveness, or collaborative visibility.

The brittle middle has become an enormous liability.

In a globalized economy marked by disruptions, increasing supply chain volatility and customer expectations which demand instant delivery and customization, the smiling curve is transforming. For the winners, the traditional U-shape is bending, with new value dynamics emerging across all segments.

For the losers, the liability of the brittle middle may drag them down, threatening even those companies whose value is currently concentrated in the upstream intellectual property or the downstream customer experience and service ends of the smiling curve.

When the Brittle Middle Undermines Strategy

Here's the paradox: even companies who’ve scaled the high value at the ends of the smiling curve, whether through innovation, design, or brand loyalty are exposed when the brittle middle fails.

A brilliant marketing campaign cannot compensate for a stockout. Demand gets generated but not fulfilled. Brand equity erodes, and customer trust vanishes faster than ad impressions.

A breakthrough product loses momentum when launch dates slip due to parts delays. First-mover advantage turns into follower status. The buzz fades. Analysts downgrade growth forecasts.

High-margin service offerings collapse when parts and labor are misaligned. Missed SLAs lead to chargebacks, contract losses, and reputational damage that no rebate can fix.

Premium pricing fails when customers experience delays and uncertainty. Buyers don’t pay for chaos. Perceived value drops, and discounting becomes the only path to volume. When reps promise what the warehouse can’t ship, relationships deteriorate, and credibility burns.

Cross-sell opportunities disappear when you can’t deliver on core promises. Why would a customer expand their spend, if you can't deliver the basics?

Customization backfires due to execution drags as supply chains can't keep up with configuration complexity. Lead times balloon, order accuracy drops, and the value of personalization gets wiped out by frustration.

A broken supply chain speaks louder than any tagline. Competitors gain leverage. Operational noise turns into financial failure.

In 1992 the sagging middle was invisible. In today’s complex and volatile global supply chain networks, the middle isn’t invisible—it’s foundational.

Adaptation is Critical - Case for a Demand-Driven, End-to-End Solution

Volatility Rewards Agility.

Static, efficient-but-brittle systems are penalized.

The "I want it now" mindset makes speed and reliability non-negotiable. Brands that fail to deliver instantly lose loyalty. In a VUCA world, value creation shifts from predictive planning to adaptive execution. The new smiling curve rewards agile orchestration in the messy, volatile middle which creates real value when it can be responsive to consumer tastes faster and more reliably. What’s needed is not just digitization, or more data but rather a return to first principles, and a change to the logic of FLOW.

Instead of pushing inventory and information forward over long cumulative lead times based on expectations or guesses, companies need to shift to an end-to-end pull-based system that senses actual demand and synchronizes supply upstream accordingly. The winning organizations will be those who synchronize execution back upstream, not just locally within a plant or warehouse, but across the network and who decouple at strategic points to create points of independence that flatten the bullwhip.

When implemented, this type of system stabilizes the middle in the face of change and challenges. This softens the brittle center and raises the bottom of the smiling curve, turning a drag on value into a synchronized contributor. The smiling curve doesn’t just stay intact - it rises. And as the middle rises, the ends rise even more.

Why Supply Chain Winners Will Earn a Disproportionate Share of Value

By elevating the operational “brittle middle” of the supply chain through end-to-end, demand-pull that protects flow, the middle no longer erodes value. It enables:

Upstream innovation becomes faster to monetize.

Downstream branding becomes more reliable and scalable.

EBITDA improves, risk declines, and capital trapped in safety stock is freed for growth.

Take a close look at the chart below. You're looking at two fundamentally different futures.

The blue line shows Stan Shih’s traditional "Smiling Curve" where value clusters at the ends of the chain (R&D and CX).

The red line shows how the curve evolves for the winners in a world where volatility, uncertainty, complexity, and ambiguity are the new operating conditions. The differential between the two curves represents the value erosion which awaits those who don’t adapt fast enough – the penalty for being a laggard.

The Game Has Changed: It's No Longer Node vs. Node, It's Chain vs. Chain

In the traditional world, firms tried to squeeze costs out of each function, and internal stakeholders often competed for margin:

Ops pushed back on sales.

Procurement squeezed suppliers.

Manufacturing was minimized, outsourced, and commoditized.

In today’s world, companies don’t compete against companies. Supply chains compete against supply chains. And as the red curve shows: The winning supply chains pull the entire curve upward for all its stages. Every stage gets stronger, faster, and more value-generating - together.

Not by accident. But as a consequence of building systems designed for flow.

The Shift from Efficiency to Flow

Why is the red curve higher at every point?

Because these supply chains have made a strategic pivot:

From unit-cost-driven efficiency → to flow-driven adaptability

From isolated stage optimization → to end-to-end alignment

From push systems → to pull systems

They operate in real time, with visibility from demand to raw material. They buffer smartly, not wastefully. They respond fast to both negative shocks and upside opportunities. And that earns them more margin, more loyalty, and more opportunity - across the board.

But Here’s the Catch: The Curve Doesn’t Rise for Everyone

The difference between the two lines is not theoretical. It’s economics. It’s existential.

The gap between the red curve and the blue curve represents the growing delta between the supply chains that adapt and the ones that don’t. And that value doesn’t appear out of thin air.

It gets taken - by faster, more adaptive competitors.

When you’re out of stock, they’re in stock.

When your launch slips, theirs accelerates.

When your system breaks under stress, theirs absorbs it and gets stronger.

The Strategic Mandate

If you're a business owner, investor, or executive leader, ask yourself:

Are we building a supply chain that can sense, respond, and adapt in real time or one that only works when the forecast is right?

Because the winners in this next era are the ones building for resilience, investing in coherence, and operating at a tempo the old models can’t match.

Conclusion: The New Winners Won’t Be the Old Ones

The VUCA world is rewriting the rules of value creation.

The smiling curve, once a clear U-shape favoring R&D and branding, now rewards agile execution in the midstream, customer-centricity in the downstream, and consumer savvy innovation upstream.

The brittle middle of supply chains, long neglected in many industries in favor of high-gloss branding and R&D innovation, has become the silent killer of agility and profitability in the VUCA world.

But with a demand-pull, end-to-end synchronization approach, we can reinforce the smiling curve’s weakest point and transform the middle from a cost center into a value amplifier.

Stop Optimizing. Start Fortifying.

Companies that cling to the old model, worshiping “islands” of efficiency will soon find that what looks like “efficiency” on paper, behaves like fragility in the real world.

Your supply chain may be more brittle than your balance sheet reveals.

Most leadership teams don’t realize how fragile their operations truly are until the stress hits, which by then, it's too late. Many leadership teams live under the false blanket of security they get because their supply chain framework is nice and tidy, that is, until the stressors hit it.

Four Questions You Can Ask About Your Company Today:

1. Can we absorb a major demand shock or a significant drop in revenue over six months, without destroying our margins or gutting our supply chain?

2. Could we seize a sudden 50% spike in demand without collapsing delivery performance, losing customer trust, or igniting chaos across our supply base?

3. Can we scale operations profitably without overbuilding, over-hiring, or crushing quality and company culture under the weight of reactive decisions?

4. Are we building a supply chain that gets stronger or more fragile with every shock?

If you hesitated on any of these questions, your supply chain probably isn’t agile – it’s probably fragile and your systems are optimized for yesterday’s volatility, not tomorrow’s.

Would you like to learn more about end-to-end pull and how to build a more resilient supply chain that reliably delivers no matter how volatile your demand patterns or the lengths of your lead-times?

If you work in supply chain management / planning and are seeking a unique opportunity to make a fast, positive and significant contribution to corporate performance in service, earnings & cash flow